How We Manage a ₹1 Lakh EMI on ₹2.2 Lakh Income Without Stress

When people hear that as a couple we pay an EMI (Equated Monthly Instalment) of ₹1 lakh every month, their first reaction is often: “That’s almost half your income! How do you manage it without stress?”

The truth is, handling such a big EMI isn’t about being super wealthy. It’s about planning, coordination as a couple, and creating financial safety nets. In this blog, we’ll share how we handle our ₹1 lakh EMI comfortably on a combined income of ₹2.2 lakh—and how you too can approach big financial commitments without losing sleep.

Ad Placeholder #1

1. Mindset Shift: Seeing EMI as Growth, Not Burden

Initially, the EMI felt intimidating. Half of our income vanishing before we even touched it? Scary.

But then we reframed it: this EMI isn’t money lost—it’s money going into an appreciating asset (our home) and our future stability. Once we began viewing the EMI as a form of forced saving and wealth-building, it felt less like a chain and more like a ladder.

Lesson: If your EMI builds an asset that appreciates (like real estate) or creates life stability (like your own home), it’s not a liability. It’s structured wealth creation.

2. Setting the Right Ratio: EMI-to-Income Balance

Financial planners often suggest that your EMI should not exceed 30–35% of household income. In our case:

- Household income: ₹2.2 lakh/month

- EMI: ₹1 lakh/month (~45%)

Yes, it’s above the ideal range. But we made it work by keeping our other fixed expenses tight. We don’t stretch lifestyle costs beyond ₹60–70k a month, leaving room for savings.

Lesson: If your EMI is on the higher side, balance it by trimming lifestyle expenses temporarily until your income grows.

3. The Budget Formula We Follow

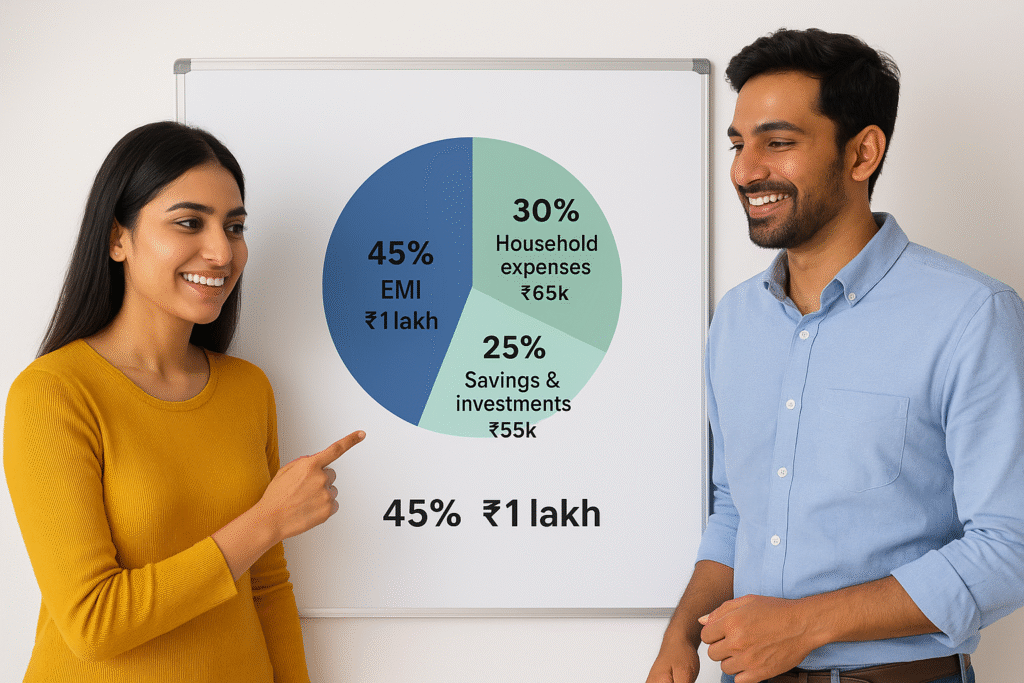

We couldn’t follow the classic 50-30-20 rule because our EMI is so large compared to our income. So, we designed our own version:

- 45% → EMI (₹1 lakh)

- 30% → Household expenses (₹65k approx.)

- 25% → Savings & investments (₹55k)

This ensures that even while servicing a heavy loan, we still save. The key is discipline—no drifting into lifestyle inflation just because we want something.

Ad Placeholder #2

4. Emergency Fund: Our True Stress-Relief

The biggest safety net we created was an emergency fund of 6 months’ EMI + expenses (~₹10 lakh). We built it over time before committing to the EMI.

So even if one of us loses a job or income slows down, our EMI and lifestyle are safe for at least 6 months. That psychological buffer removes 80% of the stress.

Lesson: Don’t commit to a heavy EMI without a fallback fund. It’s your peace-of-mind money.

5. Two Incomes = Double Safety

One big advantage we have as a couple is dual income streams. Even if one person’s income drops, the other can still keep things afloat. This shared responsibility makes the EMI much more manageable than if a single person were handling it.

Lesson: Couples should plan EMIs based on combined stability but still ensure one partner’s income can cover essentials if required.

6. Living Smart: Cutting Without Feeling Deprived

We consciously avoid unnecessary lifestyle pressure. Here’s how:

- We cook at home 70% of the time but treat ourselves to nice meals out instead of random takeout.

- We avoid piling up gadgets and clothes we don’t really need.

- We prioritize experiences over possessions—like trips or workshops.

This balance ensures we don’t feel deprived, but we also don’t overspend.

Lesson: To manage a large EMI, spend with intention. You’ll be surprised how much wasteful spending disappears.

7. Automating Payments = Zero Stress

Our EMI auto-debits at the start of the month. We also auto-transfer ₹30–40k into investments right after salaries are credited. This way:

- EMI → handled first

- Savings → handled second

- Expenses → adjusted with what’s left

This reverse budgeting approach (pay yourself and the bank first, live on the rest) keeps us disciplined without daily stress.

Lesson: Automate. When you don’t “see” the EMI or savings as free money, you don’t overspend.

8. Side Income: Small but Powerful

We both dabble in side hustles—consulting gigs, writing, and occasional freelancing. Even if they bring in ₹20–30k extra a month, we treat it as bonus money for:

- Prepaying small chunks of the loan

- Travel fund

- Building long-term investments

This cushion makes us feel like we’re progressing beyond just “surviving the EMI.”

Lesson: Even small side hustles reduce the psychological weight of a big EMI.

Ad Placeholder #3

9. Loan Health Check: Staying Sharp

Every year, we check whether refinancing or switching banks makes sense. With changing interest rates, a small tweak can save lakhs over the loan tenure. Recently, we refinanced and reduced our interest by 0.5%—which shaved off nearly ₹4,000 from our EMI.

Lesson: Don’t take a loan and forget about it. Review, refinance, and optimize.

10. The Mental Game: Not Letting EMI Define Us

We remind ourselves often: our EMI doesn’t own us—we own it.

It’s easy to slip into negativity: “Half our income goes to the bank.” But instead, we flip it: “Half our income is building our future home and wealth.” This mindset shift keeps resentment at bay and gives us peace.

Lesson: Separate your identity from your debt. A loan is just a financial tool—it doesn’t define who you are.

Final Thoughts

Managing a ₹1 lakh EMI on a ₹2.2 lakh household income may sound overwhelming, but with the right systems it becomes routine. Our formula looks like this:

- Keep EMI manageable with strict budgeting

- Build an emergency fund as the stress buffer

- Use two incomes + side hustles smartly

- Automate payments so nothing slips

- Optimize loans and keep lifestyle grounded

Most importantly, we see the EMI not as a burden, but as a structured step toward financial stability. Instead of sleepless nights, we sleep peacefully—because the numbers add up, and the plan works.

If you’re considering a big EMI, remember: it’s not about the number itself—it’s about how well you prepare for it. With planning, even a 1 lakh EMI can feel like just another line in the budget.Top of Form

Related Posts

- 7 Stress-Busting Wellness Tricks Every Indian Millennial Needs in 2025

Proven Stress-Busting Wellness Habits for Indian Millennials in 2025: Simple Daily Rituals for Mental Health…

- How Just-Married Couples Can Buy Their First Flat in Bangalore on a Modest Income

Couple’s Guide to Buying a Flat in Bangalore on ₹2 Lakh/Month or Less Buying a…