Couple’s Guide to Buying a Flat in Bangalore on ₹2 Lakh/Month or Less

Buying a home in Bangalore is one of the biggest financial milestones for a young couple. But if you’re just starting out—earning a modest couple of lakhs a month, with no parental support or family backing—the idea can feel overwhelming. High real estate prices, long loan tenures, and the cost of living in a metro city add to the challenge.

The good news? With the right planning, patience, and a bit of compromise, it is possible. Let’s break it down step by step.

Ad Placeholder #1

Step 1: Define a Realistic Budget

Your first decision should be about affordability. Most financial advisors recommend that your home loan EMI should not exceed 30–35% of your take-home income.

- If your combined monthly income is around ₹2 lakh, keep your EMI in the range of ₹50,000–₹60,000.

- With current interest rates and 20-year tenures, this typically translates to a loan eligibility of ₹50–60 lakh.

- Add your savings (ideally ₹10–15 lakh) to this, and your target property budget should be around ₹60–75 lakh.

Think of this not as a restriction but as your safety net. Overstretching EMI obligations early in marriage can cause long-term stress.

Step 2: Build the Down Payment Fund

Banks usually finance 75–80% of the property value. The remaining 20–25% is your responsibility.

- For a ₹70 lakh apartment, you’ll need ₹15–20 lakh upfront.

- Add another ₹3–5 lakh buffer for registration, interiors, and hidden costs (more on this later).

How to Save Effectively

- Set aside ₹30–50K every month. Automate savings before spending.

- Use short-to-medium term mutual funds, recurring deposits, or debt funds for safe but better-than-savings-account returns.

- Dedicate the first 2–3 years of married life to aggressive savings. This might mean renting smaller, cutting vacations, or delaying big lifestyle spends.

Many couples treat this phase as an “investment bootcamp”—living frugally for 24–36 months in order to enjoy stability later.

Ad Placeholder #2

Step 3: Choose Location with a Long-Term Lens

Bangalore is a city of micro-markets. Prices differ dramatically depending on location and future infrastructure. As first-time buyers, avoid overly premium localities. Instead, focus on affordability + growth potential.

Areas Worth Exploring (as of now):

- North: Hennur, Yelahanka, Bagalur (airport proximity, metro expansion)

- East: Kadugodi, Channasandra, Seegehalli (close to Whitefield IT hub)

- South-East: Sarjapur extension, Attibele, Chandapura (popular with IT professionals)

- West: Kengeri, Rajarajeshwari Nagar (benefiting from metro lines)

Avoid zones like Indiranagar, Koramangala, or HSR Layout for your first home—prices are inflated, and rental yields are low. You can always upgrade later.

Step 4: Maximize Loan Eligibility with a Joint Home Loan

Since you’re a couple, apply for a joint home loan. Both incomes are considered, which increases loan eligibility and also gives tax benefits under Section 80C and 24(b).

You’ll need:

- Last 3–6 months’ salary slips

- Income tax returns (last 2–3 years)

- Bank statements

- A healthy CIBIL score (750+ recommended)

Top lenders for salaried homebuyers include SBI, HDFC, LIC Housing, and ICICI.

Step 5: Take Advantage of First-Time Buyer Benefits

- PMAY (Pradhan Mantri Awas Yojana): If you qualify under the MIG-I/MIG-II categories, you may get subsidies up to ₹2.67 lakh.

- Builder Offers: Some builders offer schemes like “No EMI till possession” or discounts for first-time buyers.

- Ready-to-Move vs. Under-Construction: If you are paying rent, ready-to-move homes reduce the double burden of rent + EMI. But if you can handle overlap, under-construction may be cheaper.

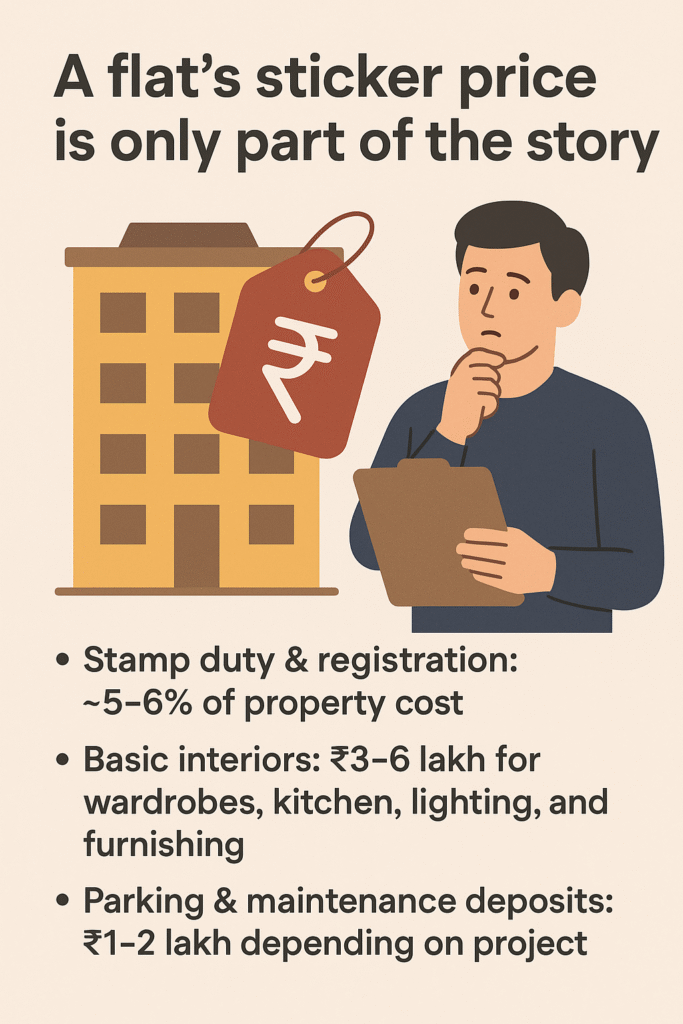

Step 6: Don’t Ignore Hidden Costs

A flat’s sticker price is only part of the story. Prepare for:

- Stamp duty & registration: ~5–6% of property cost

- Basic interiors: ₹3–6 lakh for wardrobes, kitchen, lighting, and furnishing

- Parking & maintenance deposits: ₹1–2 lakh depending on project

- Miscellaneous legal/processing charges

Always keep ₹3–5 lakh as an emergency buffer even after down payment.

Ad Placeholder #3

Step 7: Consider Alternative Strategies

If your budget feels tight, you can still make progress toward home ownership:

- Start Small: Buy a compact 1BHK or a smaller 2BHK. After 5 years, sell and upgrade.

- Buy on the Outskirts: Areas like Devanahalli, Sarjapur extension, or Mysore Road are cheaper and will benefit from metro/IT development.

- Invest in a Plot First: Land in peripheral Bangalore is often more affordable and appreciates well. You can build later when income grows.

Realistic Timeline

Year | Action |

Year 1 | Save aggressively, understand market, shortlist areas/projects |

Year 2 | Accumulate ₹10–15 lakh in down payment funds |

Year 3 | Apply for joint loan, book property, and move in |

Final Thought

For a young couple starting with no parental support, the first home purchase is less about luxury and more about stability. Think of it as building a financial anchor for your future. By saving aggressively, choosing the right micro-market, and borrowing smartly, you can absolutely own a flat in Bangalore within 3–5 years of marriage.

Discipline today will give you the freedom to dream bigger tomorrow.

FAQs

- How much salary is needed to buy a flat in Bangalore?

Most banks expect your EMI to be within 30–35% of your monthly salary. For a ₹60–70 lakh flat, you’ll need a combined household income of ₹1.5–2 lakh/month with a good credit score.

- How can newly married couples save for a down payment in Bangalore?

Couples should aim to save ₹50,000–70,000 per month through recurring deposits, debt mutual funds, or liquid funds. Living in a smaller rented house, avoiding car loans, and delaying lifestyle upgrades can help build a ₹15–20 lakh down payment in 2–3 years.

- Which areas in Bangalore are affordable for first-time homebuyers?

Affordable yet promising localities include:

- North: Yelahanka, Hennur, Bagalur

- East: Kadugodi, Channasandra, Seegehalli

- South-East: Sarjapur Extension, Attibele, Chandapura

- West: Kengeri, Rajarajeshwari Nagar

These areas benefit from upcoming metro lines and IT expansion, making them ideal for long-term investment.

- Should couples buy a ready-to-move or under-construction flat in Bangalore?

- Ready-to-move: Best if you’re already paying rent, as it avoids double burden (rent + EMI).

- Under-construction: Often cheaper, but comes with risks like delays. Suitable if you can manage overlap and are confident about the builder’s reputation.

- Can first-time buyers get government benefits in Bangalore?

Yes. Under Pradhan Mantri Awas Yojana (PMAY), eligible first-time buyers can get a subsidy of up to ₹2.67 lakh on their home loan, depending on income category.

- What hidden costs should couples plan for when buying a flat?

Apart from the flat’s price, budget for:

- Stamp duty & registration: ~5–6%

- Basic interiors: ₹3–6 lakh

- Parking & maintenance deposits: ₹1–2 lakh

- Legal & processing charges

Always keep an extra ₹3–5 lakh buffer aside.

Related Posts

- 5 Conversations That Happiest Couples Keep Coming Back To

5 Conversations That Happiest Couples Keep Coming Back To When people imagine what makes a…